This obviously hinges on the performance of the panels so having that reliable useful life will ensure you ll get the maximum amount for your home sale taking the solar into account.

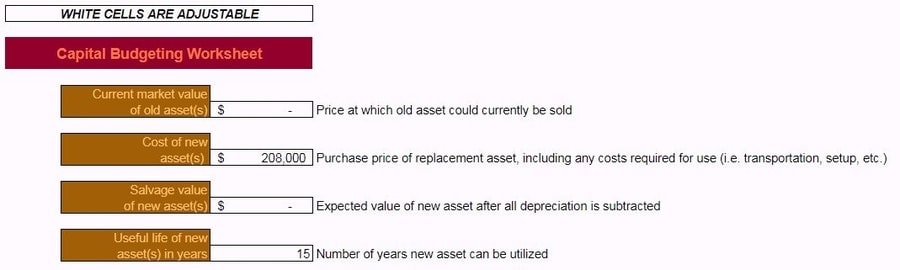

Estimated useful life for solar panels for depreciation.

It looks like solar panels have a 5 year life.

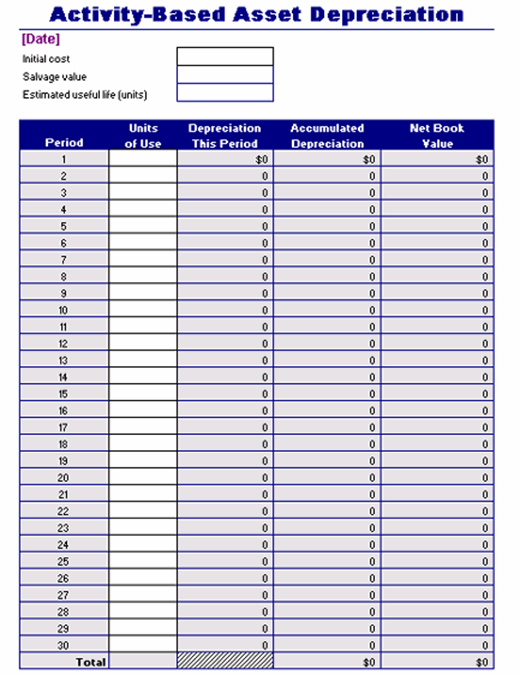

Those panels could retain 96 of their production capabilities after 20 years.

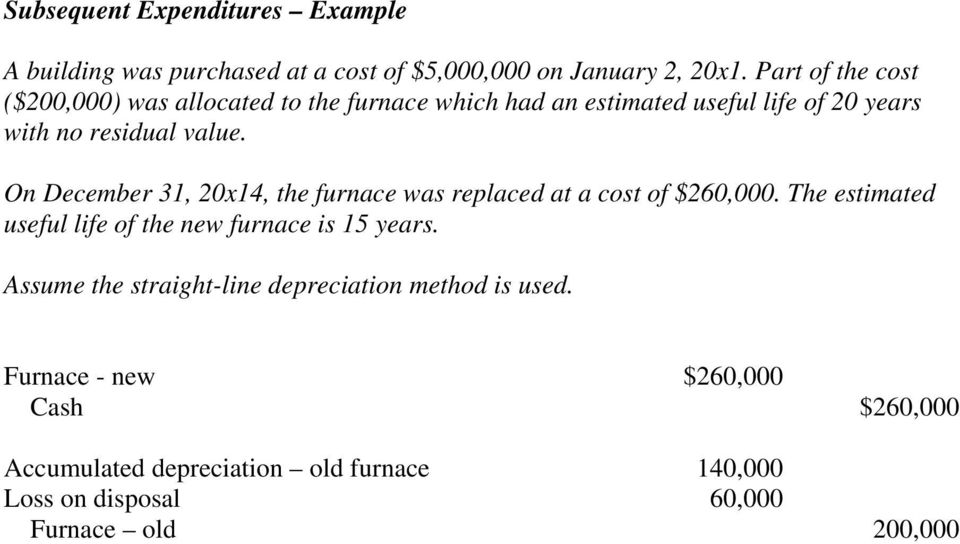

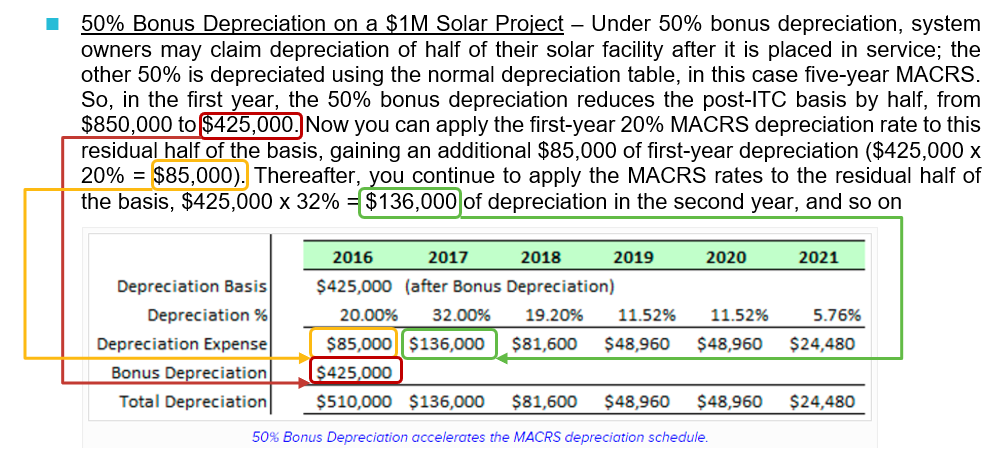

The tax cut and jobs act of 2017 brought with it the option for 100 bonus depreciation on solar systems which is often a great way for businesses to quickly recover costs associated.

Solar site assessors use these rates.

For most tier 1 solar panels the degradation rate is 30 meaning that each year the panels performance is reduced by 30.

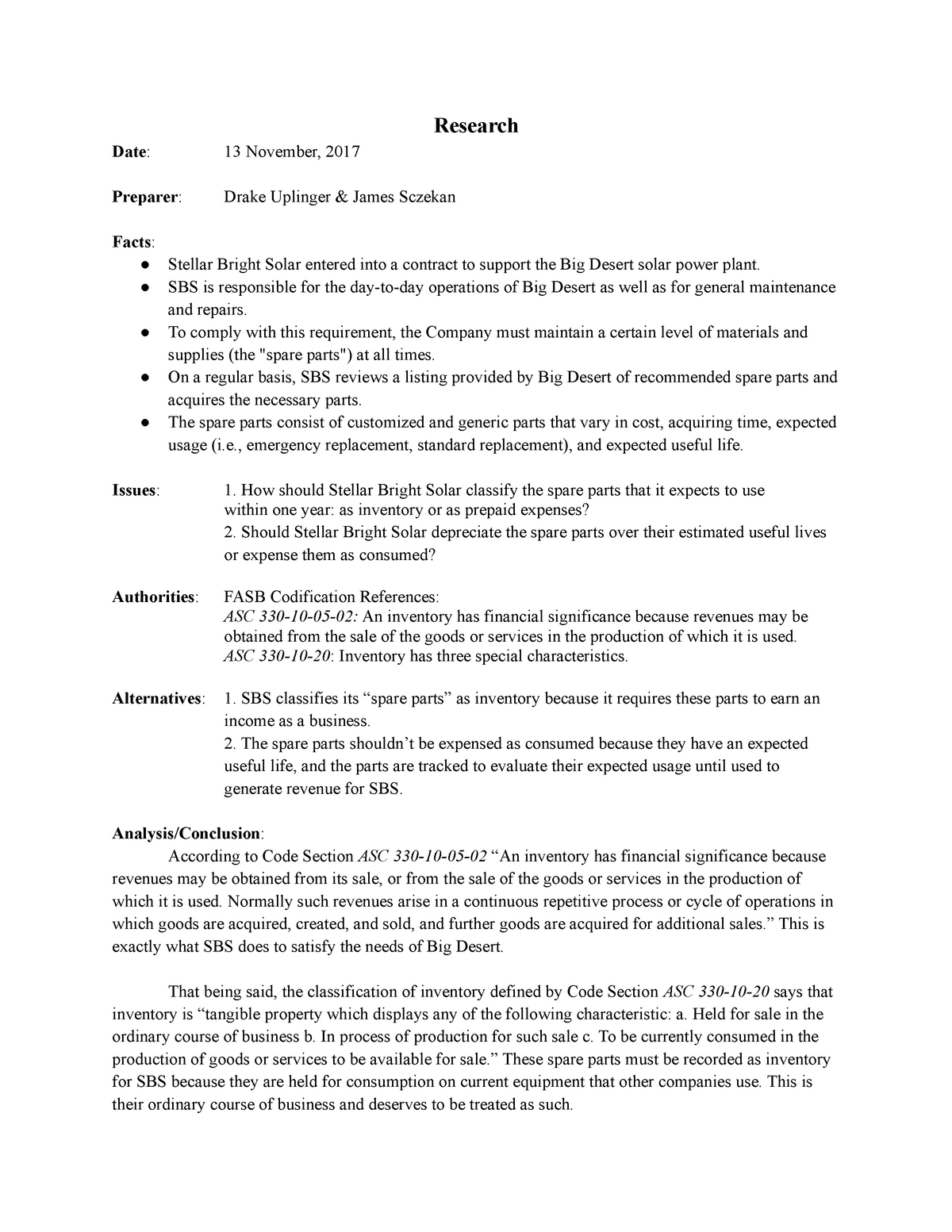

Depreciation on solar panels is one of the easiest ways businesses and farms looking to go solar can keep installation costs down rois high and paybacks short.

However this year you can use 100 bonus depreciation if you would like to take the full cost as depreciation expense in 2018.

Over 25 years that adds up to a total of 6 96 meaning your panels will operate at 93 04 of their original capacity in 2045.

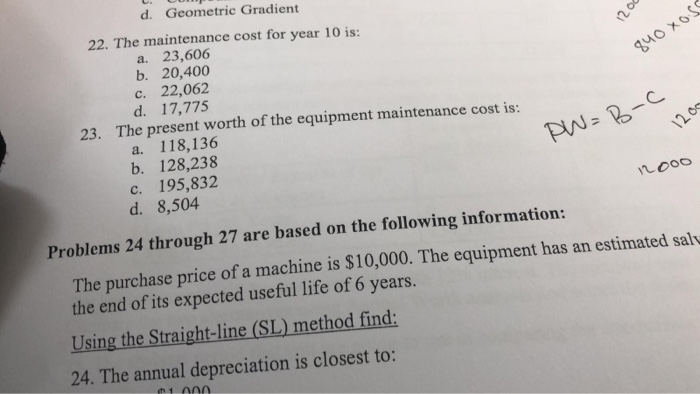

Class depreciation timeframes vary between three and 50 years depending on the certain type of property.

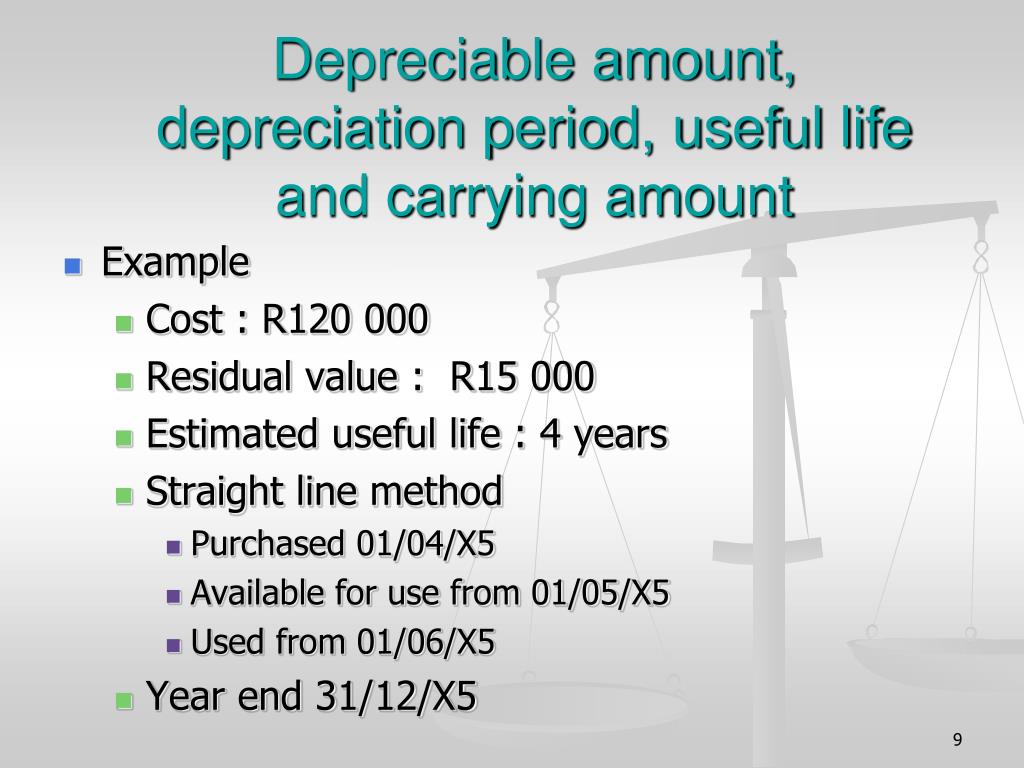

Photovoltaic electricity generating system assets incorporating photovoltaic panels mounting frames and inverters 20 years.

Macrs is the method of depreciation used for most property though assets vary by class which determines the depreciable life or cost recovery period of the property.

Degradation rates are used in solar site assessments in order to estimate the energy production over the life of a system and to calculate the payback period and return on investment.

More importantly i don t know your whole situation but i feel like you are eligible for a form 3468 investment credit for your solar panels.